The volatile world of forex trading presents both substantial opportunities and considerable risks. For traders in India, navigating this complex landscape requires a deep understanding of market mechanics, risk management strategies, and the specific regulatory environment. Proficient forex trading involves meticulous research, strategic decision-making, and the ability to respond to constantly changing market conditions.

A essential step for aspiring forex traders in India is to educate themselves with the complexities of currency trading. This encompasses understanding various technical and fundamental analysis tools, as well as developing a robust risk management plan to minimize potential losses.

- Additionally, it's critical to choose a reputable and regulated forex broker that provides access to the required trading platforms and tools.

- Thorough due diligence should be conducted before choosing a broker, ensuring they are compliant with Indian regulatory requirements.

Forex trading in India can be a lucrative endeavor when approached with prudence. By acquiring the necessary knowledge, skills, and risk management practices, traders can maximize their chances of success in this challenging market.

Navigating the Best Forex Brokers in India for 2023

The Indian forex market is booming, presenting significant opportunities for traders. However, with a vast of brokers available, choosing the right one can be daunting. This article uncovers the top forex brokers in India for 2023, helping you make the perfect platform for your trading requirements.

Here's what we'll consider:

* **Regulation and Security:** We prioritize brokers regulated by reputable authorities to ensure your funds are protected.

* **Trading Platform and Tools:** A user-friendly platform with advanced charting tools, technical indicators, and real-time market data is essential for successful trading.

* **Spreads and Commissions:** We compare the spreads and commissions charged by different brokers to help you maximize your profitability.

* **Customer Support:** Responsive and click here knowledgeable customer support is important when you need assistance or have concerns.

We'll also review the specific features and benefits of each broker, allowing you to make an intelligent decision.

Best Forex Trading Apps in India: Your Pocket-Sized Gateway to Global Markets

Dive into the world of forex trading with the top mobile applications available in India. These user-friendly platforms offer real-time market data, sophisticated charting tools, and secure deposit processing, empowering you to trade your portfolio on the go.

Whether you're a novice trader or a seasoned veteran, these apps provide the features you need to excel in the dynamic forex market.

Uncover some of the top-rated forex trading apps that are transforming the way Indian traders access with global markets:

*

*

*

Navigating the Indian Forex Landscape: Choosing the Right Broker for You

The Indian forex market presents significant opportunities for traders and investors. However, with a vast range of brokers available, identifying the right one can be a daunting task.

To succeed in this dynamic landscape, it is vital to carefully evaluate your trading needs and goals.

Consider factors such as fees, platform tools, customer service, regulatory compliance, and market availability.

Concisely, the best forex broker for you will depend on your individual circumstances. By conducting thorough research and comparing different brokers, you can make an informed decision that facilitates your forex trading journey.

Demystifying Forex Trading: Top Brokers and Strategies for Indian Investors

Forex trading can seem difficult at first glance, but with the right knowledge and tools, it can be a lucrative opportunity for Indian investors.

Choosing the best forex broker is crucial for success. Some of the top brokers in India include [brokers list], each offering unique features and benefits.

Consider factors such as regulation, trading platform, spreads, customer assistance, and account types when making your decision.

Once you have a broker, it's time to develop a sound trading plan. Technical analysis involves interpreting price charts and indicators to identify patterns and trends. Fundamental analysis, on the other hand, focuses on economic factors that impact currency values.

Successful forex traders often employ a combination of both technical and fundamental analysis to make informed trading calls. Risk management is also paramount. Always use stop-loss orders to limit your potential losses and never invest more than you can afford to lose.

Unlocking Profit Potential: A Comprehensive Guide to Forex Trading in India

The forex arena is a dynamic and booming global network, offering individuals in India the opportunity to participate in high-stakes financial activities. However, navigating this complex ecosystem requires a comprehensive understanding of market movements and a well-defined trading approach. A comprehensive guide to forex trading in India should encompass fundamental aspects such as market analysis, risk control, order execution, and the specifics of trading platforms.

- Beginners should prioritize building a solid foundation by educating themselves with market fundamentals.

- Experienced traders can leverage advanced methods to optimize their earnings.

- Staying updated of market developments and economic events is crucial for implementing well-informed trading choices.

Thriving forex trading in India necessitates a synthesis of knowledge, skills, and discipline. By adopting a strategic approach, traders can unlock the immense profit possibilities that the forex market has to offer.

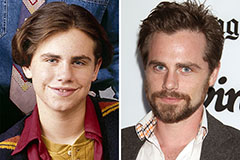

Rider Strong Then & Now!

Rider Strong Then & Now! Jenna Von Oy Then & Now!

Jenna Von Oy Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! David Faustino Then & Now!

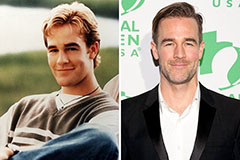

David Faustino Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now!